| Resources | Blog |

Articles |

Booking Demo |

Forum |

Help Pages |

How-To Videos |

Releases |

||||||||||||||||

| Resources: Blog |  |

|

We are in the process of providing more in the way of Owner Statements, either in addition to or as an enhancement to the existing Owner Report.

We would like to hear from as many members as possible about this, so we can provide a flexible, configurable Owner Statement feature that suits everyone's needs.

Please weigh-in here with your ideal requirements. We would like to foster a discussion about this here to help us shape this feature.

Thanks,

John

We would like to hear from as many members as possible about this, so we can provide a flexible, configurable Owner Statement feature that suits everyone's needs.

Please weigh-in here with your ideal requirements. We would like to foster a discussion about this here to help us shape this feature.

Thanks,

John

31 Responses:

dlxhivac, May 11, 2014:

dlxhivac, May 11, 2014:

John Amato, May 12, 2014:

John Amato, May 12, 2014:

John Amato, May 12, 2014:

John Amato, May 12, 2014:

John Amato, May 12, 2014:

John Amato, May 12, 2014:

John Amato, May 12, 2014:

John Amato, May 12, 2014:

geri's place, May 16, 2014:

geri's place, May 16, 2014:

John Amato, May 16, 2014:

John Amato, May 16, 2014:

John Amato, May 20, 2014:

John Amato, May 20, 2014:

RentJekyll, July 23, 2014:

RentJekyll, July 23, 2014:

John Amato, July 23, 2014:

John Amato, July 23, 2014:

RentJekyll, July 23, 2014:

RentJekyll, July 23, 2014:

John Amato, September 1, 2014:

John Amato, September 1, 2014:

Niseko Boutiques, September 10, 2014:

Niseko Boutiques, September 10, 2014:

John Amato, September 10, 2014:

John Amato, September 10, 2014:

Niseko Boutiques, September 10, 2014:

Niseko Boutiques, September 10, 2014:

nance, September 10, 2014:

nance, September 10, 2014:

tristarland, November 9, 2014:

tristarland, November 9, 2014:

John Amato, November 16, 2014:

John Amato, November 16, 2014:

Niseko Boutiques, January 14, 2015:

Niseko Boutiques, January 14, 2015:

John Amato, January 15, 2015:

John Amato, January 15, 2015:

Sabeli Villas.c.b. - E30811939, January 22, 2015:

Sabeli Villas.c.b. - E30811939, January 22, 2015:

tristarland, January 22, 2015:

tristarland, January 22, 2015:

John Amato, January 23, 2015:

John Amato, January 23, 2015:

Sabeli Villas.c.b. - E30811939, January 23, 2015:

Sabeli Villas.c.b. - E30811939, January 23, 2015:

tristarland, January 23, 2015:

tristarland, January 23, 2015:

John Amato, January 23, 2015:

John Amato, January 23, 2015:

rkmaui.com, August 29, 2018:

rkmaui.com, August 29, 2018:

John Amato, August 29, 2018:

John Amato, August 29, 2018:

Reply »

I would like a modification of the taxable receipts report. I need this type of data to pay my monthly state tax bill. I would like to see the modified report itemize and total in one column monthly receipts, in 2nd column receipts minus included prorated fees (i.e. prorated cleaning fees), in third column minus included prorated fees and prorated tax. Finally a column with mode of payment such as check, Paypal or credit card. I use this to find the service fees from PayPal and my credit card processor.

Tom - thanks for the feedback. I think I'm going to move your post to a new topic about that report, as it's pretty different from what we're talking about here.

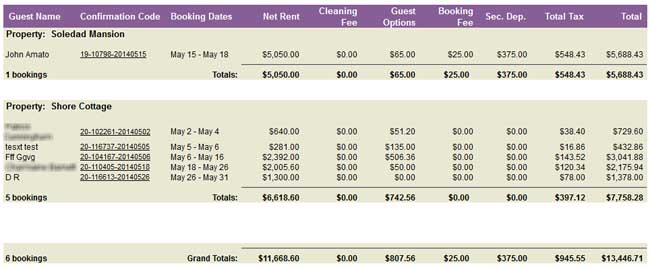

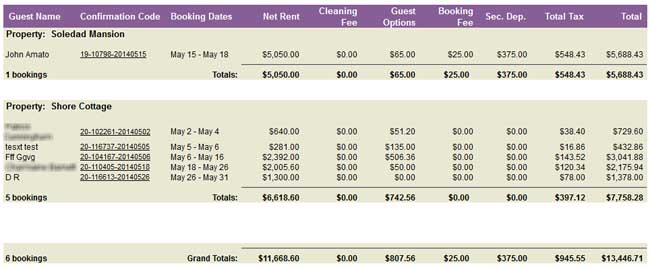

Here's the existing "Owner Report" that we are using as a starting point for the Owner Statement:

Based on some discussion with existing members, this is not a bad place to start, as it shows, for each booking, the revenue figures pretty much in their entirety.

The next step would be to list the expenses under each booking, that are being charged to the owner. These will be deducted (subtracted) from the total. Expenses will include any expenses that are related to the booking (more on this later), and also the commission figure that the property manager is retaining. The end goal, I believe, is to arrive at a final total that the property manager is going to remit to the owner.

Does this sound about right?

Based on some discussion with existing members, this is not a bad place to start, as it shows, for each booking, the revenue figures pretty much in their entirety.

The next step would be to list the expenses under each booking, that are being charged to the owner. These will be deducted (subtracted) from the total. Expenses will include any expenses that are related to the booking (more on this later), and also the commission figure that the property manager is retaining. The end goal, I believe, is to arrive at a final total that the property manager is going to remit to the owner.

Does this sound about right?

Automatic Expenses:

At the risk of muddying these already complicated waters, I feel I need to mention here that we are also gearing up to implement automatic expenses. You'll want to read up on this, as it ties in extensively with the new Owner Statments.

These will be very similar to other automatic features in Bookerville, where you define certain expenses that get automatically created for you each time a booking is created, for example. Many property managers have expenses that they "pass-through", or charge to the owners, including cleaning fees, pet fees, etc. There will be the ability to mark certain expenses as "owner pass through", or "owner charged". These are the expenses that will appear in the owner statement under each booking, to be subtracted from the total.

Your commission will also appear there, as this is an expense from the owner's perspective.

There can also be expenses that are auto-generated as a result of a guest choosing a specific Guest Option. Pet cleaning fees might be one example of this. So we are interested in exploring automating that as well, if there is enough interest in the community.

At the risk of muddying these already complicated waters, I feel I need to mention here that we are also gearing up to implement automatic expenses. You'll want to read up on this, as it ties in extensively with the new Owner Statments.

These will be very similar to other automatic features in Bookerville, where you define certain expenses that get automatically created for you each time a booking is created, for example. Many property managers have expenses that they "pass-through", or charge to the owners, including cleaning fees, pet fees, etc. There will be the ability to mark certain expenses as "owner pass through", or "owner charged". These are the expenses that will appear in the owner statement under each booking, to be subtracted from the total.

Your commission will also appear there, as this is an expense from the owner's perspective.

There can also be expenses that are auto-generated as a result of a guest choosing a specific Guest Option. Pet cleaning fees might be one example of this. So we are interested in exploring automating that as well, if there is enough interest in the community.

Security Deposits:

Refundable security deposits also need to be examined in the context of an owner statement. I think in the general sense, most of the time the security deposit is simply refunded (in whole) back to the guest after check-out. For this reason, the report shows it, but does not add it to the total for each booking.

But what happens when the security deposit is retained, either all or part (or in some cases, even more is collected)?

We currently have a "refunded" check-box to indicate when the security deposit has been sent back. Should there also be a check-box that indicates it has been retained? If we do that, then in the owner statements (and elsewhere?) the security deposit amount can be added to the booking total, since in those cases it is part of the booking revenue, presumably to counter an expense.

Thoughts?

Refundable security deposits also need to be examined in the context of an owner statement. I think in the general sense, most of the time the security deposit is simply refunded (in whole) back to the guest after check-out. For this reason, the report shows it, but does not add it to the total for each booking.

But what happens when the security deposit is retained, either all or part (or in some cases, even more is collected)?

We currently have a "refunded" check-box to indicate when the security deposit has been sent back. Should there also be a check-box that indicates it has been retained? If we do that, then in the owner statements (and elsewhere?) the security deposit amount can be added to the booking total, since in those cases it is part of the booking revenue, presumably to counter an expense.

Thoughts?

Hi John,

This sounds great, the auto expenses would be very helpful for creating owed statements. Looking forward to trying it, for me that is the best way that I will be able to wrap my head around what works, what doesn't, and what it's lacking. One question I have though is will it be possible to override automatic expenses if necessary in select bookings.

This sounds great, the auto expenses would be very helpful for creating owed statements. Looking forward to trying it, for me that is the best way that I will be able to wrap my head around what works, what doesn't, and what it's lacking. One question I have though is will it be possible to override automatic expenses if necessary in select bookings.

Yes absolutely - it is critical to be able to override/overwrite/delete any expenses that get created automatically, and that's an excellent question.

Our first-stab at this, in fact, will be 100% manual; in other words, there will not be any automatic expenses at first, rather only the ability to manually enter expenses that are tied to specific bookings, and also designated as "Owner Pass-Through", or "Owner Charged". This is what will cause those expenses to appear on the new Owner Statement. We expect this manual-only phase to only be temporary, with the automatic expenses being implemented soon after. It's not expected that members will entering these expenses manually for long, although certainly some expenses can't be automated, so there will always be some manual activity.

Once we get some members playing with this, we will see what the feedback is, and then proceed to implement the automatic expense triggering.

Our first-stab at this, in fact, will be 100% manual; in other words, there will not be any automatic expenses at first, rather only the ability to manually enter expenses that are tied to specific bookings, and also designated as "Owner Pass-Through", or "Owner Charged". This is what will cause those expenses to appear on the new Owner Statement. We expect this manual-only phase to only be temporary, with the automatic expenses being implemented soon after. It's not expected that members will entering these expenses manually for long, although certainly some expenses can't be automated, so there will always be some manual activity.

Once we get some members playing with this, we will see what the feedback is, and then proceed to implement the automatic expense triggering.

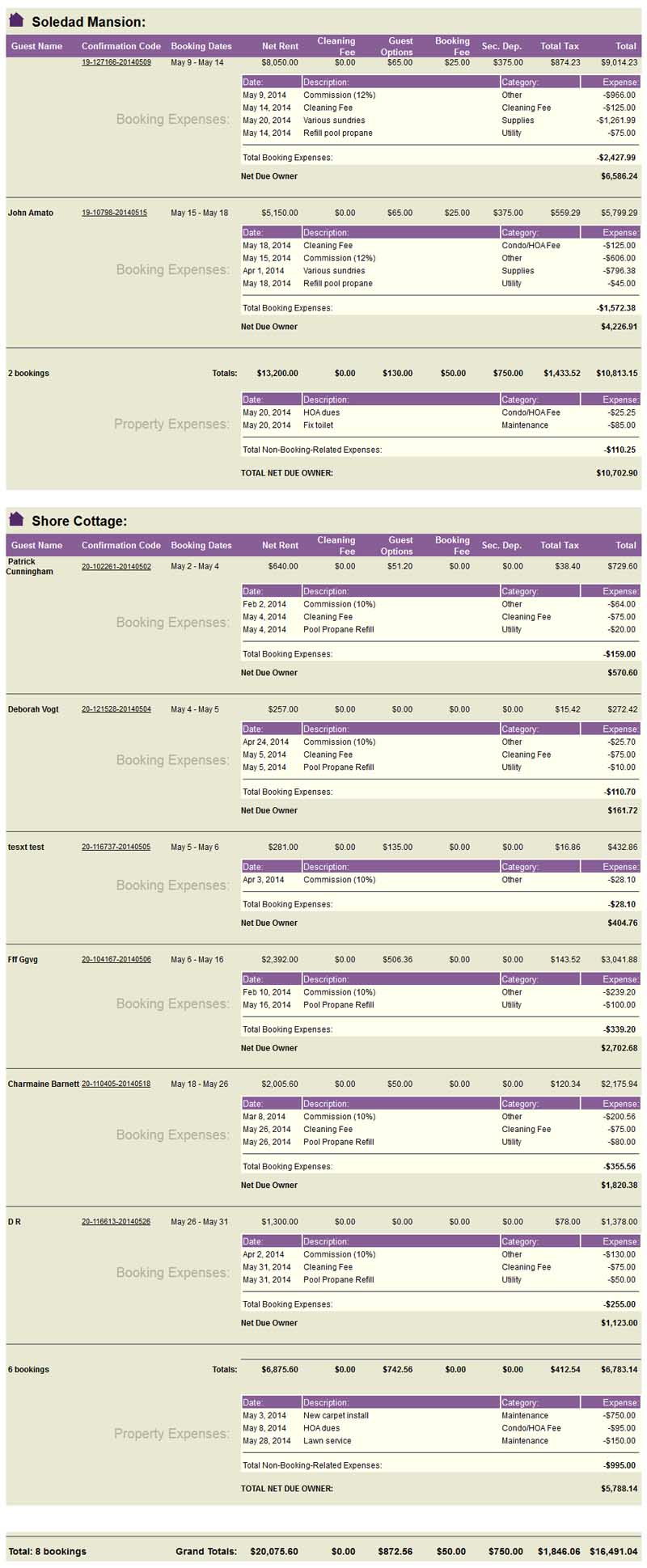

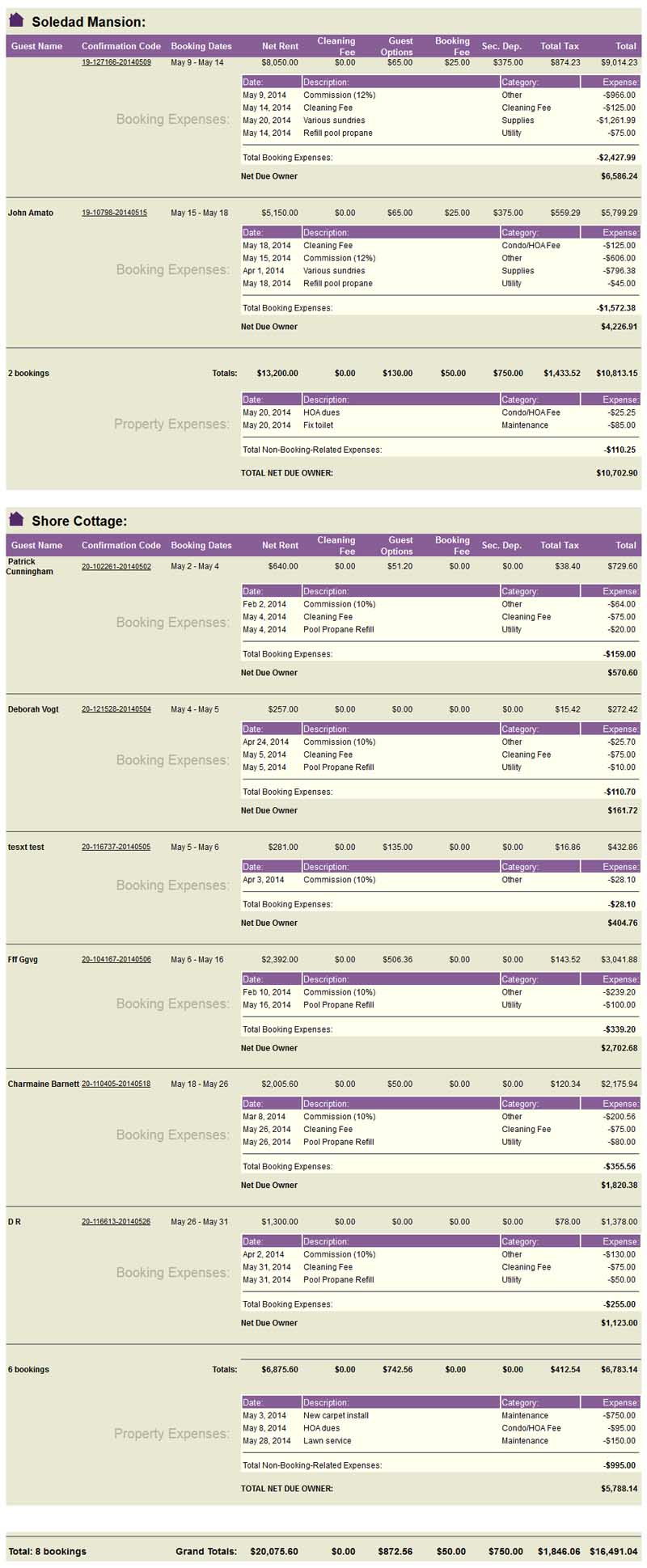

Ok, so here's a mock-up of what we currently have in mind:

Most of the time, each owner has only one property, but sometimes they have more, so this is showing two.

Each property shows all bookings. Each booking has one line that shows the revenue received, with the total as the last column.

Under that is a list of all expenses associated with that booking. (These can be automated now - more on that later in a different thread.)

These booking-related expenses are subtracted, yielding a Net Due Owner line for that booking.

This is repeated for each booking in the selected reporting period, and then a total line summing up all bookings for that property.

After that, there is a list of expenses that are not booking-related. These might be ad hoc expenses that are incurred during the period for that property, but just not related to any bookings. These are also subtracted, yielding a final NET DUE OWNER line for the property.

Thoughts?

Most of the time, each owner has only one property, but sometimes they have more, so this is showing two.

Each property shows all bookings. Each booking has one line that shows the revenue received, with the total as the last column.

Under that is a list of all expenses associated with that booking. (These can be automated now - more on that later in a different thread.)

These booking-related expenses are subtracted, yielding a Net Due Owner line for that booking.

This is repeated for each booking in the selected reporting period, and then a total line summing up all bookings for that property.

After that, there is a list of expenses that are not booking-related. These might be ad hoc expenses that are incurred during the period for that property, but just not related to any bookings. These are also subtracted, yielding a final NET DUE OWNER line for the property.

Thoughts?

Biggest thing for me is to add in the tax breakdowns. I am guessing "Total Tax" doesn't do anything for most people. I've got (1)State Tax, (2)Hotel Motel Tax, and a 3rd Tax special to our region the (3) Jekyll Island Authority Tax. Every one of those is paid to a separate entity. My guess is that most people have at least 2 breakdowns.

Also - the taxes need prorating. And just as a comment - I haven't been able to figure out the prorated rent totals yet - as they do NOT work for some reason on my accounts. Some prorate correctly, then others simply don't.

Also - the taxes need prorating. And just as a comment - I haven't been able to figure out the prorated rent totals yet - as they do NOT work for some reason on my accounts. Some prorate correctly, then others simply don't.

Hi RentJekyll, thanks for your feedback. Taxes are handled by a separate report (See your Dashboard ==> Reports tab), and can get fairly complex in their own right.

The Owner Statement is trying to show income, less expenses, and a net amount that is due the owner.

If you're noticing pro-rated amounts not working properly, please contact us with specific examples so we can correct it.

Thanks!

The Owner Statement is trying to show income, less expenses, and a net amount that is due the owner.

If you're noticing pro-rated amounts not working properly, please contact us with specific examples so we can correct it.

Thanks!

Thanks John,

I am aware of the Tax Report. Let me redirect this. How about a change/improvement to the Tax Report, where you add the Net Rent into the line item also. I've never filled out a tax report that didn't mandate me spelling out what the rent actually was that the Tax is based off of. This reduces me having to work off of multi reports. I mean - right now - I have to create a MS Word chart, then cut and paste out of multi reports in order to get a document suitable for reporting taxes.

Also - we report and pay taxes on a monthly basis, based on the same prorated agenda in the owners report. Example: July 1, 2014 to August 1 2014 will be the next combined owners report and tax report. Owners get paid on the monthly. Taxes get paid on the same monthly. So Taxes need to be prorated also.

NOTE: It would also be nice to have a field that I could check, and it would show up in the Tax Report, as to whether or not there was a tax exemption certificate associated with the stay. We get a lot of govt travellers who are always submitting tax exemption for business travel. Bloody hell of a mess - but it is mandated by law we have to give it to them. Very hard to track, and paperwork has to be attached to tax reports/payments.

NOTE 2: I guess I should add that we don't charge taxes on cleaing, but some do - so maybe that needs to be factored into this report as to what the taxes are based off of (if that is checked off - taxed cleaning fees that is).

In regards to the proration not working... I will run a sample report, save it as a pdf and email it to you.

Thanks. Please don't consider any of this to be gripeing. Just feedback. May be doable, maybe not, but they create very timeconsuming additional steps for me at least by not having them - and it just seems to me that unless the State of Georgia is different from everywhere else - most people might have these issues also.

I am aware of the Tax Report. Let me redirect this. How about a change/improvement to the Tax Report, where you add the Net Rent into the line item also. I've never filled out a tax report that didn't mandate me spelling out what the rent actually was that the Tax is based off of. This reduces me having to work off of multi reports. I mean - right now - I have to create a MS Word chart, then cut and paste out of multi reports in order to get a document suitable for reporting taxes.

Also - we report and pay taxes on a monthly basis, based on the same prorated agenda in the owners report. Example: July 1, 2014 to August 1 2014 will be the next combined owners report and tax report. Owners get paid on the monthly. Taxes get paid on the same monthly. So Taxes need to be prorated also.

NOTE: It would also be nice to have a field that I could check, and it would show up in the Tax Report, as to whether or not there was a tax exemption certificate associated with the stay. We get a lot of govt travellers who are always submitting tax exemption for business travel. Bloody hell of a mess - but it is mandated by law we have to give it to them. Very hard to track, and paperwork has to be attached to tax reports/payments.

NOTE 2: I guess I should add that we don't charge taxes on cleaing, but some do - so maybe that needs to be factored into this report as to what the taxes are based off of (if that is checked off - taxed cleaning fees that is).

In regards to the proration not working... I will run a sample report, save it as a pdf and email it to you.

Thanks. Please don't consider any of this to be gripeing. Just feedback. May be doable, maybe not, but they create very timeconsuming additional steps for me at least by not having them - and it just seems to me that unless the State of Georgia is different from everywhere else - most people might have these issues also.

RentJekyll - first, my apologies for the long delay in replying to this, and thank you for pointing it out to me on our phone call.

Quick question before I get into the details on this set of enhancements: are you using the special "Tax Exempt" Guest Option to facilitate tax-exempt bookings?

If you are, then that could be the trigger that can affect the Tax Report output.

We are just about to roll out some changes to the Tax Report (not the Owner's Statement), so please look at that in the coming days and give us your thoughts. It won't address all of this, but it should address some.

The Tax Report is "pro-rateable" just like all the other reports in the top section (check the box that says "Pro-Rate Amounts for Overlapping Bookings". If this is not working, or not working as you expect it, please report back here so we can investigate it.

Thanks!

Quick question before I get into the details on this set of enhancements: are you using the special "Tax Exempt" Guest Option to facilitate tax-exempt bookings?

If you are, then that could be the trigger that can affect the Tax Report output.

We are just about to roll out some changes to the Tax Report (not the Owner's Statement), so please look at that in the coming days and give us your thoughts. It won't address all of this, but it should address some.

The Tax Report is "pro-rateable" just like all the other reports in the top section (check the box that says "Pro-Rate Amounts for Overlapping Bookings". If this is not working, or not working as you expect it, please report back here so we can investigate it.

Thanks!

Hi John,

These changes are great. I would certainly welcome the additional options within the reports such as commission, expenses and non-booking related expenses.

One small issue I have noticed though with the reports though. I have just run a report for one of my owners and noticed that where making a multiple property booking, the total amount is reflected on the initial property and not on the subsequently booked properties.

2411-270346-20140804 is the confirmation code if you have a chance to look at this.

Cheers,

These changes are great. I would certainly welcome the additional options within the reports such as commission, expenses and non-booking related expenses.

One small issue I have noticed though with the reports though. I have just run a report for one of my owners and noticed that where making a multiple property booking, the total amount is reflected on the initial property and not on the subsequently booked properties.

2411-270346-20140804 is the confirmation code if you have a chance to look at this.

Cheers,

Good observations Niseko Boutiques. Let me ask: how should the amounts get spread over the properties in a multi-property booking?

John

John

Hi John,

As each property has a different owner, the price I hope can be recorded is the individual price per property.

i.e. 5 different properties booked @ $100 each per night would see each owner have the individual booking as part of the multi property booking reflected on their owner report as $100 instead of the initial property booked having the total $500 recorded under their owner report and nothing for the other 4.

Regards,

John

As each property has a different owner, the price I hope can be recorded is the individual price per property.

i.e. 5 different properties booked @ $100 each per night would see each owner have the individual booking as part of the multi property booking reflected on their owner report as $100 instead of the initial property booked having the total $500 recorded under their owner report and nothing for the other 4.

Regards,

John

Hi John,

This is just a note on the new format as you posted on May 20th. The new format looks good and is great when I need that much detail. But I would like the report to be a summary with the option of showing the expense details. I like the current owner's report because I can see all of the month's numbers on one page.

Thanks!

Nance

AMI Vacations Inc.

This is just a note on the new format as you posted on May 20th. The new format looks good and is great when I need that much detail. But I would like the report to be a summary with the option of showing the expense details. I like the current owner's report because I can see all of the month's numbers on one page.

Thanks!

Nance

AMI Vacations Inc.

John,

I am eagerly awaiting the new owner statement. When do you anticipate final completion. As you mentioned in a previous posting, the ultimate goal (at least for me) is for the owner to be able to see what fees (including commission) that are an expense against the net rent. I hope this is coming soon!

I am eagerly awaiting the new owner statement. When do you anticipate final completion. As you mentioned in a previous posting, the ultimate goal (at least for me) is for the owner to be able to see what fees (including commission) that are an expense against the net rent. I hope this is coming soon!

Hi Tristarland - the Owner's Statement has been available since last Spring, check your Dashboard ==> Reports tab. Run it, play with it a bit, and let us know your thoughts.

Thanks,

John

Thanks,

John

Hi John,

Just a question to ask if the 'mock-up' version from your 20 May, 2014 post has been integrated into the system? and if so, is there a need to opt in? I still have the same version from the Original post but would love to see the mock-up version in place.

Regards,

John

Just a question to ask if the 'mock-up' version from your 20 May, 2014 post has been integrated into the system? and if so, is there a need to opt in? I still have the same version from the Original post but would love to see the mock-up version in place.

Regards,

John

John - the latest changes have been rolled out quite some time ago (months), so you should be able to access it. This is the "Owner's Statement" report, in your Dashboard ==> Reports tab.

Let me know what you see...

Let me know what you see...

Out of interest, is this report supposed to be available to owners. Only I have looked at permissions available and it doesn't appear to be possible. Apologies if I have misunderstood.

I would like to get an owner statement that shows gross rent, rental commissions, expenses, and net due owner. I, personally do not like booking fees, security deposit waivers, etc. showing up in owners statements for various reasons. I would be happy to create a simple version in excel to share with Bookerville.

Sabelli Villas - it's not (yet) available to members with permissions. We want to get it out of Beta first, and then consider making it available to your sub-users.

Tristarland and Pam - we are working on an update that will give you the option to display/not display these columns (from the booking rows):

- Guest Name

- Cleaning Fee

- Booking Fee

- Guest Options (total)

- Security Deposit

- Tax

Does this sound like it would work for you?

Tristarland and Pam - we are working on an update that will give you the option to display/not display these columns (from the booking rows):

- Guest Name

- Cleaning Fee

- Booking Fee

- Guest Options (total)

- Security Deposit

- Tax

Does this sound like it would work for you?

Thanks John, I thought as much.

The additional options look good, what about Commissions & Paypal Fees, or is this going too far. Or perhaps they should stay under expenses. We might be falling into the trap of having too much information. But I suppose if you can choose !! Rgds

The additional options look good, what about Commissions & Paypal Fees, or is this going too far. Or perhaps they should stay under expenses. We might be falling into the trap of having too much information. But I suppose if you can choose !! Rgds

John, this would be perfect! Do you have a time frame for completion?

Sabelli Villas - yes, those would go into the expenses section, and check out the Recurring Expenses part for more information on that. (Post here if you want help...)

tristarland - very hopeful for next week. What we really want to do is make both versions available (the new one with selectable income fields, and the original for backwards-compatibility), until it can be verified that the new one works exactly the same way (with all options selected).

Keep your fingers crossed...

Thanks all...

tristarland - very hopeful for next week. What we really want to do is make both versions available (the new one with selectable income fields, and the original for backwards-compatibility), until it can be verified that the new one works exactly the same way (with all options selected).

Keep your fingers crossed...

Thanks all...

John,

I have a re-occurring expense (commission) set. I have pulled the "Owner's Report" and the "Owner's Statement and the expenses are showing on neither. I have know that the expenses are in the system because they are showing under the "Expense Report". Have I missed a step. It looks like the previous comments were from several years ago. This would be a valuable, time-saving tool, if I can make it work. Thank you. Shelly

I have a re-occurring expense (commission) set. I have pulled the "Owner's Report" and the "Owner's Statement and the expenses are showing on neither. I have know that the expenses are in the system because they are showing under the "Expense Report". Have I missed a step. It looks like the previous comments were from several years ago. This would be a valuable, time-saving tool, if I can make it work. Thank you. Shelly

Hi Shelly, for the recurring expense, did you check the "Owner-Paid" box?

Recent Posts:

Monthly Archives:

Categories:

- Minimum Days Between Bookings

- Property Deletes No Longer Permitted

- Bookerville's New Maintenance App

- Automated Refunds Are Here!

- Send Your Scheduled Emails Hourly

- "From" Address and Bookerville Email Delivery

- Automatic Emails and Listing Sites

- Vacation Rental Channel Managers

- At-A-Glance Tab Updates

- Bookerville Reads Your VRBO iCal Feed

- Guest Services Mobile App!

Monthly Archives:

- February 2021 (1)

- May 2020 (1)

- January 2020 (2)

- December 2019 (1)

- August 2019 (1)

- November 2018 (1)

- February 2017 (1)

- November 2016 (1)

- May 2016 (1)

- April 2016 (1)

- January 2016 (1)

- August 2015 (1)

Categories: